Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is small estate affidavit for?

A small estate affidavit is a legal document used to transfer the assets of a deceased individual to their heirs or beneficiaries without having to go through the probate process. It is typically used when the value of the estate is below a certain threshold, which varies depending on the state. The small estate affidavit allows for a simplified and faster distribution of assets, bypassing the need for court involvement.

Who is required to file small estate affidavit for?

The small estate affidavit is typically filed by the personal representative or executor of a deceased person's estate. This individual is responsible for managing the assets and debts of the deceased person and distributing them to the appropriate beneficiaries or heirs. The specific requirements for filing a small estate affidavit vary by jurisdiction, so it's important to consult with an attorney or local probate court for guidance.

How to fill out small estate affidavit for?

Filling out a small estate affidavit can vary slightly depending on your location and specific circumstances. However, here are some general steps to consider when completing a small estate affidavit:

1. Verify eligibility: First, confirm that you are eligible to use a small estate affidavit. Typically, this is applicable when the total value of the decedent's assets falls below a certain threshold specified by your state's laws.

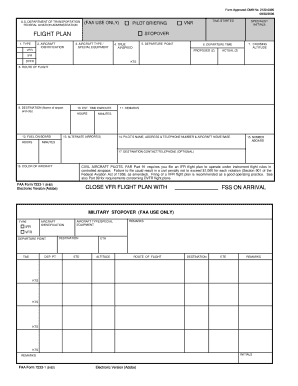

2. Obtain the necessary form: Many states provide specific forms for small estate affidavits. You can usually find them online on your state's official website or at the local courthouse. Alternatively, consult an attorney or legal professional for assistance.

3. Identify the decedent and heirs: Clearly state the full name, date of death, and other relevant information about the deceased person (decedent). Identify the heirs or beneficiaries who are entitled to inherit the assets.

4. List the assets: Enumerate all of the decedent's assets, such as bank accounts, stocks, real estate, vehicles, personal belongings, or any other property. Include accurate and specific details about each asset, such as location, outstanding loans or mortgages, and any other relevant information.

5. Gather necessary documents: Attach relevant supporting documents that validate your claims, such as death certificates, wills (if available), property titles, bank statements, and any other applicable paperwork.

6. Sign and notarize: Sign the small estate affidavit in the presence of a notary public. Notarization is required in most cases to ensure the authenticity and legality of the document.

7. Distribute the assets: Once the affidavit is completed and notarized, you can use it to facilitate the transfer of assets to the rightful heirs or beneficiaries. This may involve presenting the affidavit to banks, government agencies, or other organizations holding the decedent's assets.

8. File the affidavit: In some cases, you may need to file the small estate affidavit with the appropriate court or government entity. Check your state's regulations to determine if this step is required.

Remember that these steps are general guidelines, and the specific requirements may differ based on your state's laws. It is always advisable to consult an attorney or seek legal advice to ensure accuracy and compliance with local regulations.

What is the purpose of small estate affidavit for?

A small estate affidavit is a legal document used to transfer the assets of a deceased person to their heirs or beneficiaries without having to go through the probate process. It is typically used when the value of the deceased person's estate is below a certain threshold set by state law. The purpose of the small estate affidavit is to simplify and expedite the transfer of assets to the rightful beneficiaries and avoid the cost and time involved in probate proceedings.

What information must be reported on small estate affidavit for?

The information that must be reported on a small estate affidavit varies depending on the jurisdiction and the specific requirements of the court handling the estate. However, some common information that is typically required on a small estate affidavit includes:

1. Basic information about the deceased individual, such as their name, date of birth, date of death, and Social Security number.

2. A description of the property and assets of the deceased, including their estimated value.

3. Information about the potential creditors of the estate, including the names and addresses of known creditors.

4. The names and addresses of the beneficiaries or heirs who are entitled to receive the assets of the estate.

5. A statement confirming that the estate qualifies as a small estate under the applicable state law, typically based on the total value of the assets.

6. The signature of the person making the affidavit, who is usually the executor or personal representative of the estate.

7. Any supporting documentation required by the court, such as a death certificate or proof of assets.

It is important to consult with an attorney or review the specific laws of your jurisdiction to ensure that you include all necessary information on the small estate affidavit for your particular circumstances.

What is the penalty for the late filing of small estate affidavit for?

The penalty for late filing of a small estate affidavit (also known as an affidavit of small estate or small estate declaration) can vary depending on the jurisdiction and the specific circumstances of the case. In general, late filing of the affidavit may result in delays in the distribution of the assets, additional court fees, or even legal consequences such as fines or penalties.

Some jurisdictions may have strict deadlines for submitting the small estate affidavit, and failing to meet those deadlines can lead to complications in the estate administration process. It is important to consult with a legal professional or refer to the specific laws and regulations of your jurisdiction to determine the exact penalties for late filing.

How can I send small estate affidavit for bank account to be eSigned by others?

Once your print small estate affidavit form is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit small estate affidavit form online?

With pdfFiller, the editing process is straightforward. Open your printable small estate affidavit illinois in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I edit small estate affidavit on an Android device?

You can make any changes to PDF files, such as small estate affidavit illinois form, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.